The rise of Blockchain in the new decade

2019 has been an interesting year for Bitcoin, cryptoassets and other blockchain technologies such as Distributed Ledgers (DLT). On an annualized basis, Bitcoin’s return of nearly 100 percent has surpassed almost all traditional financial market products, e.g. US and European stocks, government and corporate bonds, and commodities. In other words, blockchain technology is starting to establish itself again after the crash of 2018 and the industry is at a turning point in 2020 with the COVID-19 pandemic and subsequent economic crisis. With the beginning of a new decade, the blockchain scene is set to go through tectonic shifts, which is why we decided to have a closer look at the main trends in the space and potential benefits for investors to get exposure to this asset class.

Overview

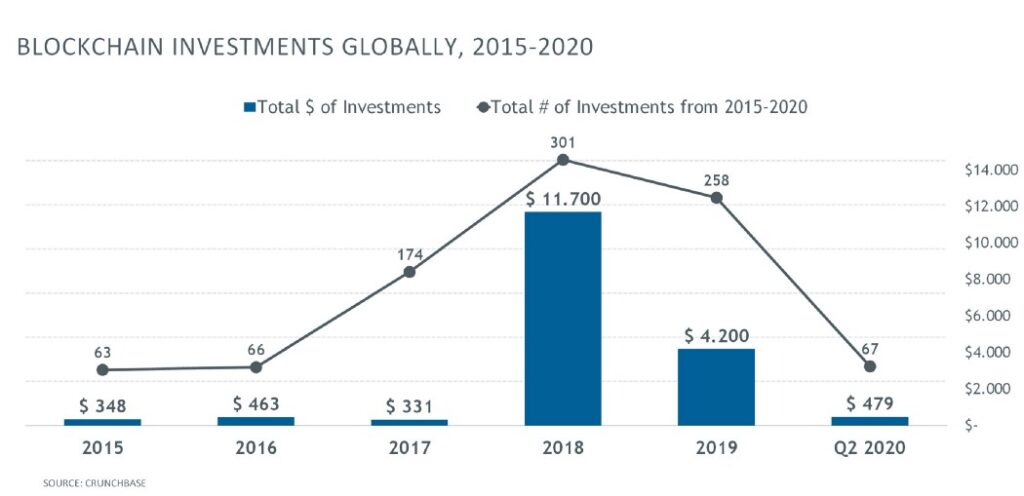

When looking back, 2018 was a particularly active year with 297 deals worth about $11.7 billion. This activity has come despite the big crypto crash with an 80% value drop, surpassing the Dot-Com Crash of 2000. Nevertheless, since then the industry has regained its strength with blockchain continuing to disrupt traditional industries and business models.

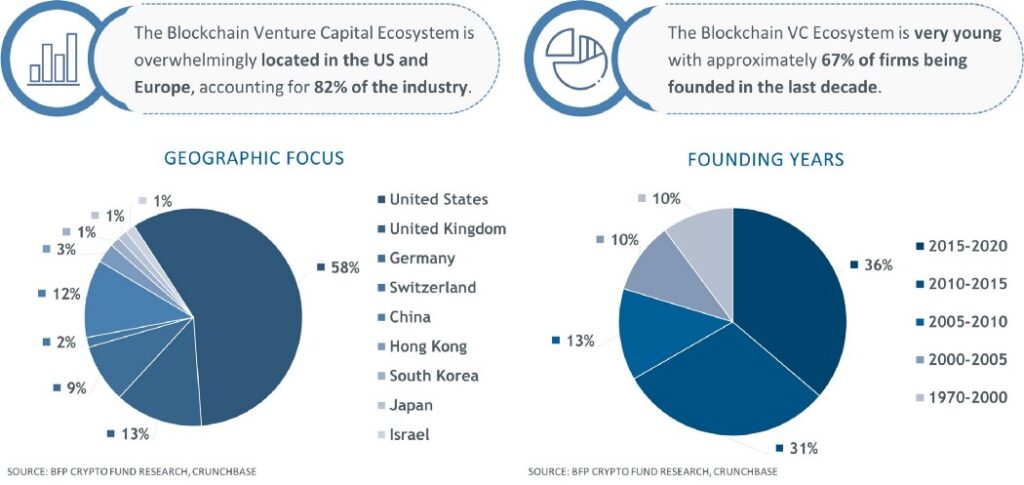

According to Crunchbase the United States are still the central hub for blockchain, however Germany is set to be the next pioneer for this technology with the new “crypto law” that came into force in early 2020. The new law will reduce regulatory uncertainty, thus attracting startups and investors. Also, the Swiss government proposed updates to the banking, corporate and financial infrastructure laws to accommodate Distributed Ledger Technology (DLT), making it a central hub for the cryptocurrency and blockchain industries in the future.

As the market is still quite young, many of the established VC funds are still generalists according to Crunchbase. Most VC firms specializing only in blockchain were founded over the last decade and focus mostly on cryptocurrencies, decentralized platforms and fintech companies.

Potential Trends for the next decade

Crypto assets seem to further emerge in the future and become mainstream around the world, driven by the infrastructure under construction and the regulatory environment for digital assets. This class is currently led by Bitcoin, being still one of the only liquid products on the market, with Bitcoin leading by far the market in terms of market capitalization.

Security tokens: Securities are tokenized

We are currently seeing the first approaches to tokenize other assets as well as regulatory frameworks that are preparing for the widespread introduction of digital assets throughout the financial industry. While traditional assets are represented in a new digital way (e.g. “tokenization of securities”), we will also see that new asset classes are transferred to known regulatory frameworks in order to make them tradable in the existing infrastructure.

Decentralized Finance (DeFi) will grow strongly in 2020

Decentralized Finance (DeFi) is a relatively new area in which we have seen major progress in the past year. In the beginning of 2019 less than $300 million was tied up in DeFi, while by the end of the year this amount more than doubled to around $700 million.

Increased liquidity with crypto investments

Blockchain and more precisely, crypto currencies, e.g. Bitcoin, as an asset class compete with other alternative asset classes, such as venture capital. Nevertheless, Blockchain differs in one key aspect, liquidity. While today the risk-return profile of both asset classes are very different, as the ecosystem evolves, Blockchain is set to benefit from the increased liquidity provided by tokens, potentially becoming a more attractive asset class, given a hypothetical similar risk-return profile in the future. Hence, both GPs and LPs should be paying close attention to the development of the market, as it can be a cause for future disruption in the VC ecosystem.

What are the benefits to invest in blockchain now?

The strong market reactions to the corona virus indicate an impending, severe recession. Governments around the world have announced unprecedented stimulus programs to support the economy and central banks also implemented expansive monetary policies by lowering short-term refinancing rates or introducing new asset purchase programs.

Fostering the development of non-cash payments

A central aspect of blockchain technology is the ability to allocate rights and ownership of assets as an electronic register. With crypto values in general, the physical cash can be digitized, which could limit the spread of the virus as it can be transmitted through currency. In addition, due to social distancing many banks were closed and limits on cash withdrawals were implemented, causing several bottlenecks. Therefore, new financial instruments can be created to remedy current inefficiencies while reducing transaction costs. There are already numerous digital payment methods from well-known technology giants such as Apple Pay and Google Pay. Digital currencies or a digital payment infrastructure could further expand the offer. A current example of this is Facebook’s Libra project. In this way, money can be conveniently transferred from A to B without the need for physical cash.

Digitizing traditional assets and currencies

In times of crisis, the demand for precious metals, such as gold and silver increases drastically. Customers see precious metals as a solid store of value and thus as an instrument to hedge against (hyper) inflation in times of crisis. It is already possible to buy tokenized gold today. Among the leading projects, PAX Gold is a crypto value secured with one troy ounce of a physical gold bar. The legal claim packaged in this crypto value is “engraved” on the blockchain. It should be noted, however, that tokenized gold issuers are currently mostly unregulated.

Identity management

The corona virus pandemic has brought to light many underlying structural inefficiencies of existing networks and technologies. Nonetheless, it can also be seen as a catalyst for technological innovation. For instance, if digital identities of people were mapped via a blockchain system, it would no longer be necessary to use a physical ID card or a health insurance card. This could result in contracts being signed with a digital identity and those affected by the virus would no longer have to physically go to places for the purpose of identity checks or signing of documents, all of this while maintain full privacy of their data. Such ideas are no longer utopian and are driving digitalization forward.

We at BFP believe that blockchain technology is an attractive asset class to be exposed to, as it ultimately has the potential to disrupt even the most established firms and industries. As early successes build on themselves, we expect blockchain to provide unique opportunities for investors in the future.

Reference

- Crunchbase

- Crypto Fund Research

- Crypto’s 80% Plunge Is Now Worse Than the Dot-Com Crash – Bloomberg

- Swiss crypto sector welcomes proposed blockchain law – Swissinfo

- The five most important blockchain trends for 2020 – Bank Blog

- Blockchain and overcoming the corona crisis: how does that fit together? – BondGuide