Introduction

Our team has visited Israel several times in the last 2 years meeting with almost 50 early stage VC firms across the country which fit our investment thesis. We have observed some of the much talked about facts about the “Start-up Nation”, such as Israel being strong on high tech and the high quality of its talented and hungry entrepreneurs. We were impressed to have all of these facts confirmed whilst digging a little deeper and are pleased to share our perspective on the Venture capital in Israel ecosystem.

Much Talked About Facts and What‘s Behind Them

Israel produces Deep Technology

Israel’s strength historically (and presently) has been in development of deep technology. Whilst more recently there have also been some extraordinary exits of consumer facing companies (e.g. Waze) the majority of successful exits have been of companies developing enterprise focused deep tech solutions (e.g. Cybersecurity, IoT and Digital Heath).

Off the back of large R&D facilities of many of the prominent tech companies (Google, Cisco etc.) and several deep tech oriented universities, Israel boasts one of the highest ratios of R&D/GDP globally (~4.2% compared to ~2.8% in the US). It also has the highest proportional share of scientists and engineers in the world (140 per 10.000 residents).

Israel has well-educated, hungry technological talent with an entrepreneurial mindset

Certainly true in our experience. Since the 90s the Israeli government has pro-actively supported a flourishing tech ecosystem with subsidies and other initiatives. Against this backdrop several generations of highly motivated, well trained entrepreneurial talent have been enabled.

The IDF (Israeli Defence Forces) also plays a pivotal role as a training ground from which many successful founders emerge. Many funds source founders specifically from the elite units of the military, which are highly esteemed in terms of pedigree of founders emerging thereof (but clearly not the only source of great founders!). Also, many founders emerge from the prestigious universities in the country (e.g. Technion, Hebrew University) which run highly respected courses in engineering and entrepreneurship.

Short distances in a geographically compact country lead to a dense and well-connected industry

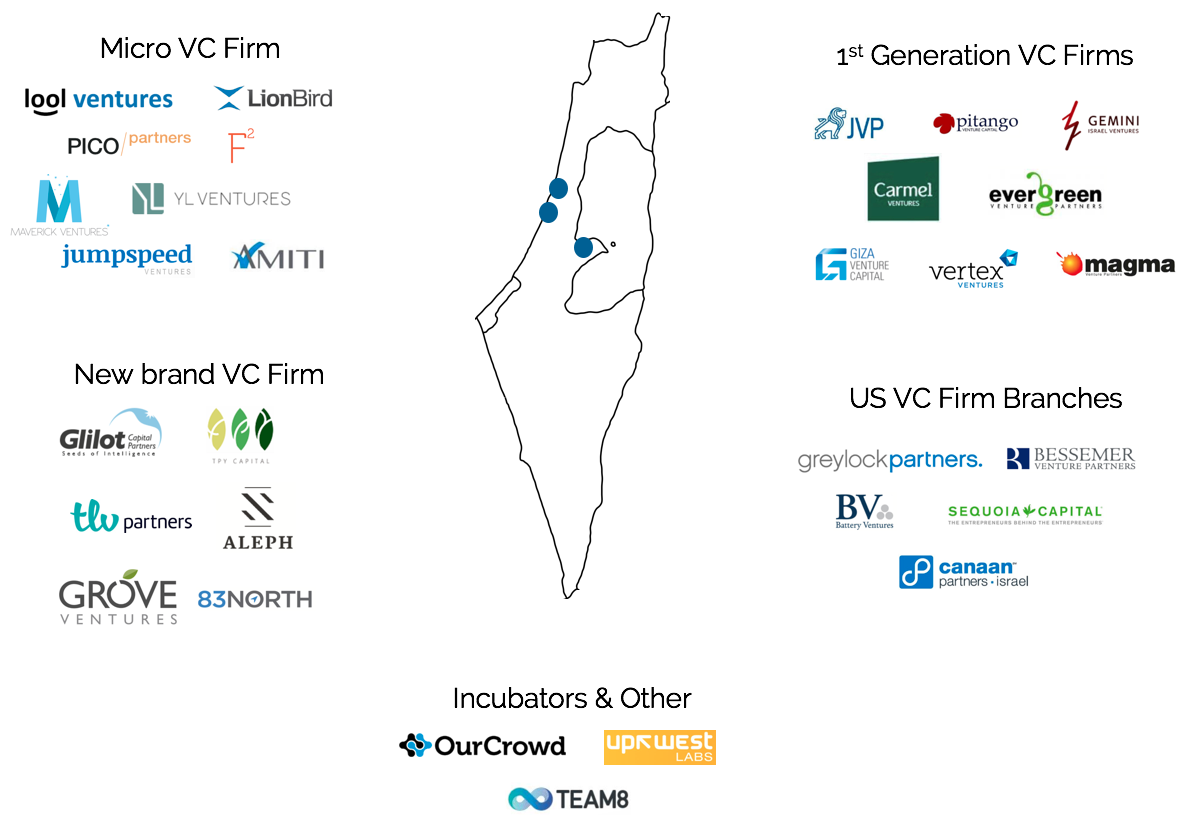

A large part of the start-up industry including most Venture Capital firms in Israel are based in Tel Aviv and Herzliya, which is about a 20 minute drive from downtown Tel Aviv (depending on traffic!). One Venture Capitalist described Tel Aviv as the San Francisco of Israel and Herzliya and surroundings to Silicon Valley, though distances in Israel between the two are even closer.

Having said this Jerusalem boasts it’s own ecosystem where amongst others veteran VC firm JVC (Jerusalem Venture Partners) are based. Jerusalem is also home to OurCrowd, the VC crowd-funding platform. Some newly emerging VC brands are now seizing on the opportunity to capitalize on an arguably underserved market.

Valuations are significantly lower compared to the main hubs in the US

Compared to the main VC hubs in the US early stage entry valuations in Israel are estimate to be 30–50% lower. VCs in Israel often target and achieve ownership levels of 20–30%, whereby initial ticket sizes are in line with those of their US peers in early stage funding rounds.

Another notable fact is that early stage Israeli VCs tend to have much more concentrated portfolios, typically made up of between 12 and 15 investments. By comparison many early stage US based VCs spread their initial investments across 25–40 companies.

Furthermore reserves for follow-on investments tend to be higher in Israel than in the US (sometimes up to 80% of fund size), again with a view of pro-actively protecting ownership stakes throughout funding rounds.

To that effect many early stage funds are quite disciplined regarding fund size staying below $150m.

Israeli start-ups are international from the beginning

With a population of < 9m and a GDP of ~$300bn, Israel has a limited domestic market. Many companies therefore start to internationalize immediately from the outset (sometimes testing the product initially at home). Most exits have been to US corporates (e.g. Waze to Google, Trusteer to IBM) historically, which is another reason why start-ups tend to internationalize early.

Several VC firms have therefore built a strong network with corporates in Europe and the US to help their companies with international expansion as a value-add service.

Many US and some European VCs have recognized this opportunity and started to invest in founders in Israel offering to help them with international expansion.

There is comparatively lots of venture capital money available

It’s well known that Israel is the number 1 worldwide in terms of having the highest amount of VC $s invested per capita ($423 vs. $186 in the US in 2015) and the highest $ value of exits per capita. Israel has attracted more VC money in absolute terms than each individual country in the EU.

Nonetheless founders are very selective choosing their investors and are willing to give up large shares of their business for the right VC firm. Israeli VCs have a tendency to lead rounds alone without syndicating to other VCs which is often seen in the US and other geographies.

Having said this many Israeli VCs mentioned that this flood of capital is mostly concentrated on later stage rounds (post Series B).

Taking into account all of the above we consider Israel to be a highly attractive market for VC investing and see strong return potential. Our capital allocation within our global fund portfolio is therefore overweight relative to global venture capital flows.

Main Players in the Tech VC Ecosystem

Sources:

- Blue Future Partners proprietary database

- Europe & Israel 2016 VC Year in Review by Gil Dibner,

- Geektime’s Israel Annual Report 2015, Geektime

- Geektime’s Israel Annual Report 2016, Geektime

- Israel — Underestimated High-Tech Location by Wolfgang Bernhart

- Research and development expenditure (% of GDP), The World Bank