The article introduces you to important key term sheet clauses, including defining preferred and common share types, liquidation waterfall and seniority, and liquidation preferences with participation. These key terms are negotiated at the time of closing investment rounds and have major implication on the returns you get as a founder when exiting your startup.

—

Key Term Sheet clauses? Ok. Let us imagine a situation, if you may — You are ambitious, visionary, and like to live life on the edge. You decide to quit your high-paying cushy corporate job to build a start-up that is going to change the world and become the next unicorn, may be even a decacorn. You build a successful tech product and raise several rounds of funding. However, a few years later you realize that your start-up even with a superior product and a decent customer base is no longer growing as it was before. One of your investors introduced you to a firm that would buy your company for some tens of millions. It’s not what you expected, but you agree to sell, nonetheless. Dust settles, your key employees, you, and your co-founder find that the equity stake that you all hold is essentially worthless. Investors, on the other hand, did much better, recouped their money, and even pocketed a positive return.

Shocked!? Well, such situations, can and do happen to some founders.

Through this article, I will try to demystify the returns to different stakeholders when a startup exits and through that, I will touch upon some key term sheet clauses.

I will be using a relatively simple and hypothetical problem statement to explain various aspects that lead to exit modeling. The final output will allow you to simulate different exit scenarios and understand how much financial returns different stakeholders will make.

You can download the problem statement and the solution by clicking here.

This article is not a tutorial to build a financial model from scratch, but I have attached the completed and unlocked version excel model for you to learn from. The objective of the article is to introduce key term sheet clauses that impacts startup exits.

I. Key Term Sheet Clauses: Preferred vs. Common Shares

When institutional VC investors invest in a startup, they demand Preferred shares. Founders and key employees do not get Preferred shares, they get Common shares. Angels, incubators, accelerators, and likes may or may not demand preferred shares.

Preferred shares holders, unlike Common shares holders, receive preferential treatment. They have special rights. These rights are negotiable and are included in the term sheet. The most common and important right is the liquidation preference. Liquidation preferences mitigate the risk investors take by ensuring they get paid first over common shareholders. The term sheet fine prints determine how much, if any, remains for you, key employees, and other common shareholders.

In the problem statement shared above, the founders, key employees, angels, and the incubator own common shares. The later investments by the angels, VC1, VC2, and VC3 are allocated with preferred shares.

II. Key Term Sheet Clauses: Liquidation Waterfall and Seniority

With multiple financing rounds into a start-up, a new clause enters the term sheet called “Seniority”. Seniority determines the preference order in which investors get their money back at the exit. Seniority ranking is usually allotted to share classes and not individual investors.

For instance, in the problem statement shared, Series B shares have the highest seniority for getting paid, Series A is next in seniority, Seed after that, and Common shareholders have the lowest seniority.

In most cases, the later investors get higher preferences. So, Series B holders are paid back first before Series A, and so on.

Therefore, the returns at exit flow in as a waterfall or rather rapids (if you are one of those people who use to top in geography classes in high school). Such an arrangement is shown below (note it simply shows preference initially without any complicated clauses like participation, which we will discuss next).

III. Key Term Sheet Clauses: Liquidation Preferences and Participation

As stated above, institutional investors demand preferred shares with liquidation preferences. It means that preferred shareholders are guaranteed proceeds over the common shareholders. The amount of return guaranteed is stated in the term sheet (after negotiation) as a multiple of amount invested in the start-up. Basis the negotiation done, it can go as high as it can be, but usually restricted to 1x of the amount invested. This clause was initially created to safeguard investors in case of the start-up was exited for a value less than expected. A 1x liquidation preference ensures investors in the start-up recover at least the initial investments.

Such liquidation preferences could either be non-participating or participating.

Non- Participating Liquidation preference:

If certain investors have preferred shares with non-participating preference, then they have a choice to convert to common shares, if payout from common shares is more than that obtained from liquidation preference. Let’s understand this through a simple example:

VC investor, Marc made a seed investment of € 2M for 40% stake in a start-up, X.

Assumption: there is no other investor in X apart from Marc who has preferred shares with non-participating preference.

In the table above, we observe that Marc as a preferred shareholder with non-participating preference is:

1. Entitled to exit proceeds first over founders of X (holder of common shares).

2. Has a choice to use liquidation preference (1x or 2x) or convert to common shares, determined by the highest amount of payout received through either of the processes.

3. We observed that Marc receives equal to or more than his % shareholding (which 40% in this case) upon exit depending on the terms agreed upon the exit value.

Participating Liquidation

In contrast, participating liquidation preference, also commonly known as double-dipping, allows investors to receive payouts in the remaining proceeds on a pro-rata basis in addition to the liquidation preference.

Using the same example above, Marc will get 40% of the remaining proceeds in addition to the payout through liquidation preference.

Participating preferred holders never convert to common shares as they are adding their participation on top of the liquidation preference, something which common shareholders do not get. Such a clause is not at all founder friendly.

In the problem statement shared, Series B shareholders have participating preferred shares and also have a special right to obtain accrued dividends at the exit. Series A and Seed shareholders have non-participating preferred shares.

To protect the founders from participating preferred shareholders, a clause called Participation Cap was introduced. They are also stated as a multiple of invested amount and provides a conversion threshold for participating preferred shareholders. For instance, a 2x cap indicates that the investor can only receive up to 2 times the invested amount and would have to convert to common shares to receive a higher payout.

Let’s use the same example as above in which Marc has a liquidation preference of 1x.

Many other clauses form the part of a term sheet. In case you are interested and want me to author a follow-on article covering certain other clauses, please send me your suggestions to as@bfp.vc or put them below in the comment section. Moreover, if you are an emerging VC fund with fund size less than $200M and investing in early-stage rounds (pre-seed, seed, late seed and Series A) and want to know more about our work and investments, please feel free to drop in an email and I will connect with you.

—

About Abhisekh Shah

Abhisekh is part of the investment team at Blue Future Partners, a venture capital fund of funds investing globally in early-stage VC firms and in growth stage start-ups. He is an engineer by training and holds an MBA, specialized in Finance, from HEC Paris. Prior to joining Blue Future Partners, Abhisekh had six years of work experience, which is mainly entrepreneurial. He worked for a multi-national pharmaceutical company in their Industrial Automation division and then went on start his own startup in the luxury clothing rental space. Following that, he joined another startup (that provided SaaS based solution and advisory services to large corporate to manage their ESG objectives) in their core team to grow and build the startup, scaling it from single digit team to triple digits team across multiple offices and catered to 200+ corporate clients (including Fortune 500 companies). They raised funding from the likes of Nexus Venture Partners, Saif Partners, and Omidiyar Network.

LinkedIn – Twitter.

—

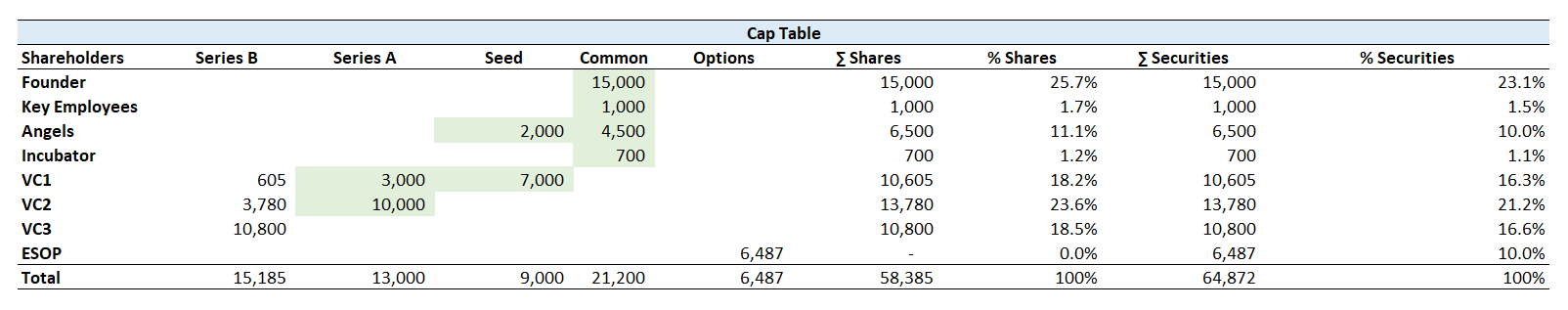

Provided below are snippets of the solution to the problem statement mentioned above. A detailed solution is there in the excel sheet that can be downloaded through the link provided at the beginning of this article.

Cap Table before later stage investments were made:

Cap Table after all the investments are made until exit:

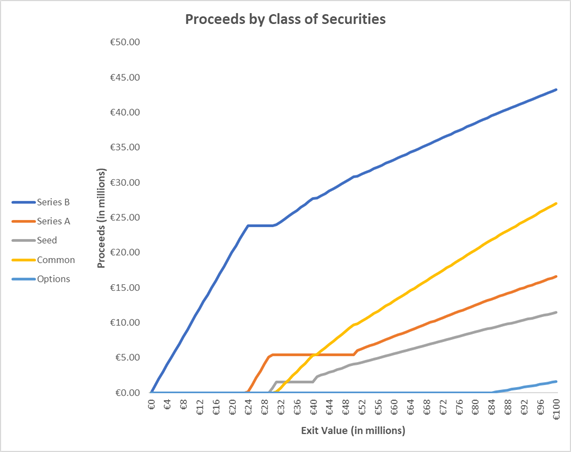

Final Proceeds charts: