Yet another Trillion Dollar Opportunity?

The changing climate is arguably the most significant challenge facing humanity today. We at Blue Future Partners believe that the resulting problems can only be solved through technology and are very interested in the long-term change the investment world will have to go through arising from this.

As part of our Landscape Overviews, we are kicking off a new series dedicated specifically to Climate Tech. In this intro article, we explore the history, main verticals and investment opportunities of Climate Tech and will want to dive deeper into specific sectors and exciting companies in the future.

Tech as a solution to the dilemma of growth

The five warmest years on record were in the past five years and climate disasters cost the world over 650 billion USD in the last three years. These two numbers alone illustrate the extreme urgency of taking climate action to guarantee a livable future for humanity.

The main dilemma of climate change is :

i) The global population is expected to increase exponentially by around 25% to 9.7bn by 2050; however, consumption growth is an unfortunate causality of population growth with the two positively correlated. Nevertheless, all the planet’s inhabitants have the right to a decent standard of living, meaning a continuation of this undesirable pattern.

ii) Consumption reduction is currently the only plausible solution; however, with our current economic growth model, an increase in consumption will continue to be a symptom of greater global prosperity. A fundamental shift in our economic growth model is required; however, it is unclear what form this will be in, whether it will hold any resemblance to the status quo or be entirely new. *

As a result, we at Blue Future Partners see technology as the only real solution to the dilemma of growth. We need to rethink the way we eat, move, live and consume through technology to build a society in harmony with the planet. Thankfully some changes are already underway. This brings huge opportunities for investors and entrepreneurs who work on solving the problems arising from climate change.

Genesis — From Clean Tech to Climate Tech

Many tech investors still have a bad aftertaste from investing into startups trying to tackle climate change. In the early 2000s, investors poured billions into Clean Tech startups with the dream of solving the climate crisis. But fluctuating silicon prices, falling gas prices, the Chinese solar industry and the 2008 financial crisis caused many high-profile startups to fail. Leading up to 2011, American VC firms alone lost over 100 billion USD investing into Clean Tech, which doesn’t include all the tax credits and public loans.

But despite this initial failure, climate technologies are looking bright again. The global solar industry is five times bigger today than in 2010 thanks to lower module and networking costs. Energy companies like Tesla are disrupting decade-old and highly polluting industries and have made for one of the best tech investments in recent times. These trends suggest that this time it should be different for climate technologies. Much like many internet business models that failed because of the 2000 crisis made a comeback years later.

PWCs Definition of “Climate Tech”

This brings us to today. Now we are in the age of “Climate Tech”. While Clean Tech was all about energy startups with hardware products, Climate Tech is used in a broader term. It refers to any technology that decarbonates our economy, including not just energy, but also food, construction and even infrastructure. Climate Tech encompasses not just “direct” climate technology, but also indirect measures like farming software that reduces water consumption.

PWC in their report ”The State of Climate Tech 2020” put forth 5 main Climate Tech verticals with several sub-verticals each:

Infrastructure, Food, Energy, Mobility and Heavy industry.

This categorization raises two important questions. First, all of them are established investment verticals – so is mobility for example still a separate vertical or does it make more sense to understand it as part of Climate Tech now?

We are seeing an interesting phenomenon where different verticals are converging now and can no longer be regarded independently. If an industry significantly contributes to global warming, any efforts to decarbonate it with technology will make it fall under Climate Tech. Two specific examples of this are PropTech and AgriTech, which are both independent verticals but play a huge role in reducing carbon emissions. Even though it makes sense to talk about PropTech independently, it needs to play a significant role in today’s climate conversations.

A second question that arises for investors : to what extent are these verticals actually growing as a result of solving climate challenges? As we will see in the next two paragraphs, there is a massive investment opportunity in Climate Tech and each of the 5 verticals is already seeing significant influx of capital as a result.

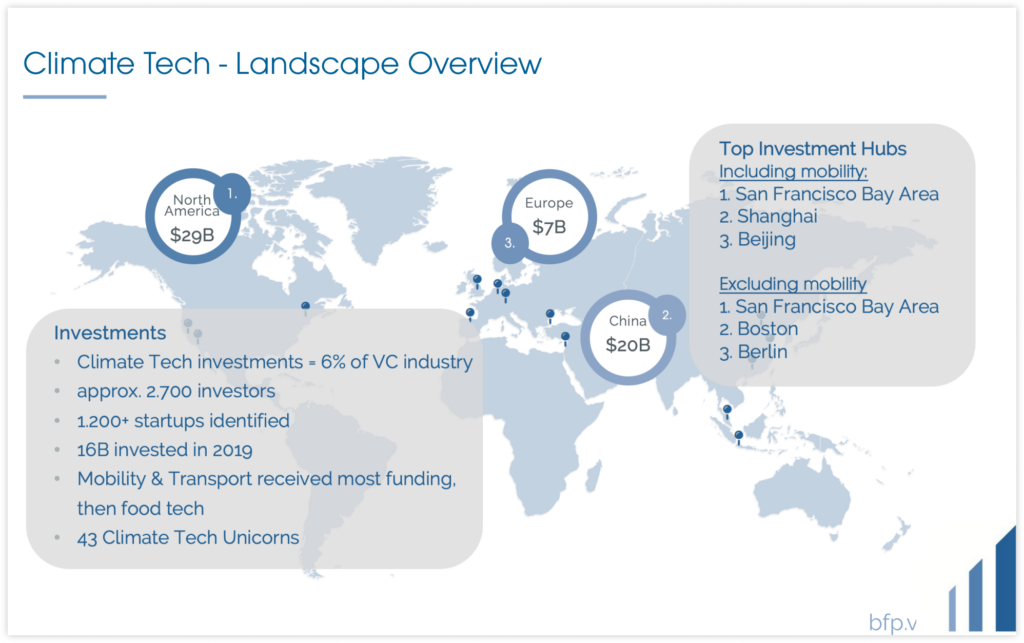

The Opportunity in Climate Tech

Declining cost curves, increasing computing power, more consumer demand for sustainable businesses and government regulations are unlocking entirely new business models for the next generation of entrepreneurs tackling climate change. A report by the Global Commission on the Economy and Climate found that climate action could deliver 26 trillion USD in economic benefits through 2030 in emerging markets alone. At the same time, many existing assets face the risk of becoming “stranded” and losing value, with The Economist estimating that 4.2 trillion USD of value in global financial assets is at risk from climate change.

Climate Tech Investments

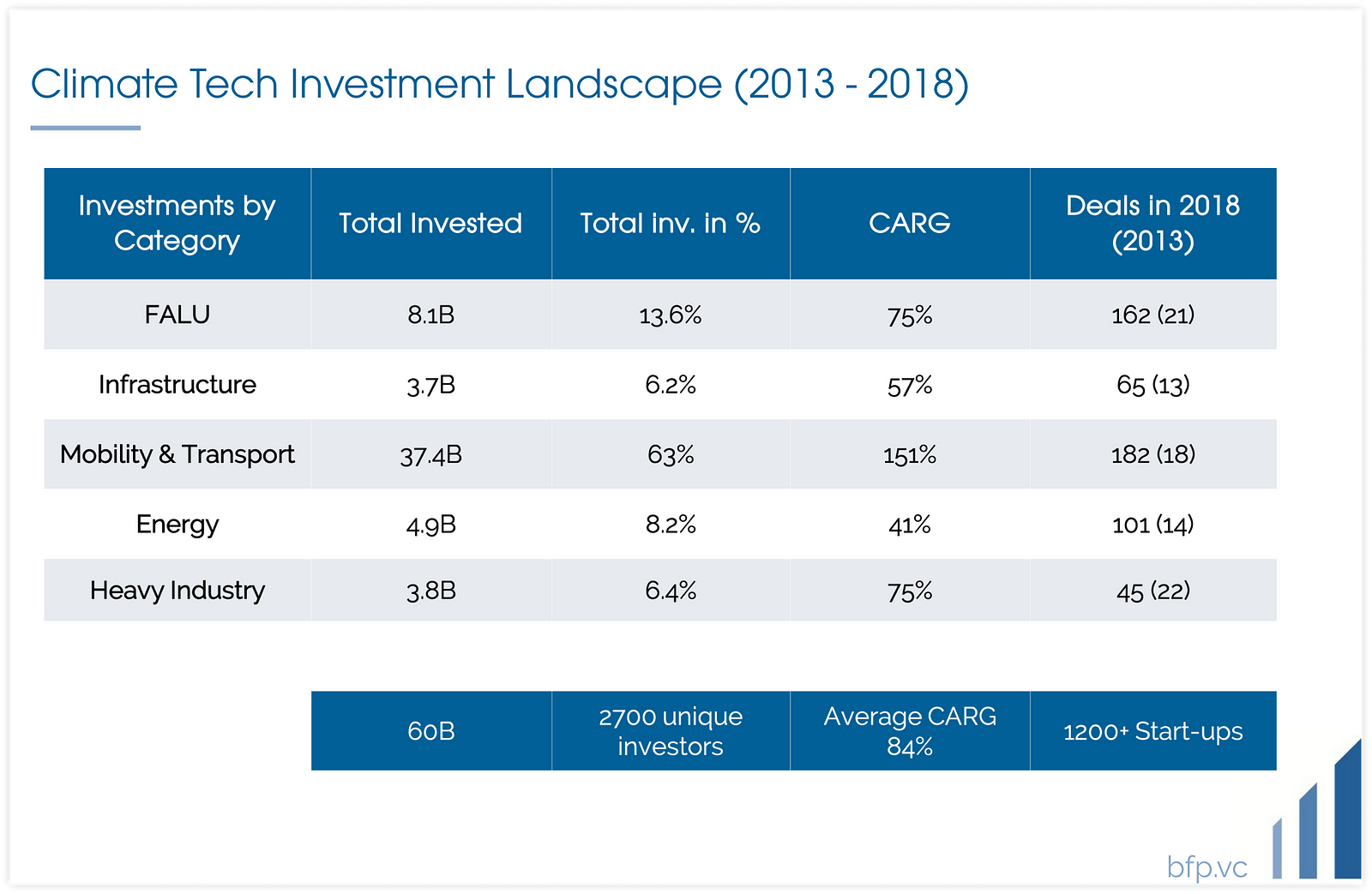

Here is an overview of investments into each of the five Climate Tech verticals since 2013.

Wrap up

To sum up, it is inevitable that global energy and resource consumption will continue to rise in the future. At least for the next decades, the world’s population will keep growing and living standards will keep rising. Technology can play a role in slowing the problems arising from the dilemma of growth. We need to rethink our ways of living through technology and drastically transform all areas of our economy to minimize their impact on the planet. This transformation will bring massive opportunities for investors who allocate their capital to help solve this challenge.

In the coming months, we will continue to expand this Climate Tech series. We will explore investment opportunities in the sub sectors of Climate Tech, highlight game changing companies and hopefully foster an ongoing discussion on how we as an investment community can play our part in solving the climate crisis.

If you want to collaborate with us on research, articles and interviews, please dm us on twitter @bluefutureteam!

*Thanks to Munashe Demawatema for the contribution!

Sources:

- Bloomberg — Is Climate Tech Different Enough From the Cleantech of Old?

- CNBC — Climate disasters cost the world $650 billion over 3 years

- Columbia University — How Climate Change Impacts the Economy

- Economist Intelligence Unit — The cost of inaction

- EY — Climate Change — The Investment Perspective

- National Geographic — The last five years were the hottest ever recorded

- The New Climate Economy — 2018 Report of the Global Commission on the Economy and Climate

- real asset insight — PropTech: technology, climate crisis and tenant demands are changing real estate sector business models

- PWC — The State of Climate Tech 2020